- MENU

- HOME

- SEARCH

- WORLD

- MAIN

- AFRICA

- ASIA

- BALKANS

- EUROPE

- LATIN AMERICA

- MIDDLE EAST

- United Kingdom

- United States

- Argentina

- Australia

- Austria

- Benelux

- Brazil

- Canada

- China

- France

- Germany

- Greece

- Hungary

- India

- Indonesia

- Ireland

- Israel

- Italy

- Japan

- Korea

- Mexico

- New Zealand

- Pakistan

- Philippines

- Poland

- Russia

- South Africa

- Spain

- Taiwan

- Turkey

- USA

- BUSINESS

- WEALTH

- STOCKS

- TECH

- HEALTH

- LIFESTYLE

- ENTERTAINMENT

- SPORTS

- RSS

- iHaveNet.com

By George Magnus

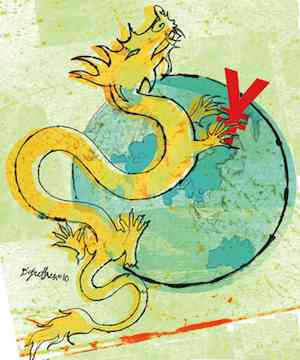

Is this the Chinese century, and will Beijing again dominate the global system as it did from before the birth of Christ to roughly 1800? These weighty questions have received additional impetus in the wake of the devastating financial crisis and its tough and protracted consequences for the United States and other western nations. The contrast with an economically and increasingly politically self-confident China could hardly be more stark. Yet, global futures cannot be projected in the linear and a political form, which many employ. There are serious challenges ahead for China.

The comprehensive reforms unleashed by Deng Xiaoping in 1978 set China off on an explosive path to become America's main geopolitical rival, the world's second largest economy, its biggest exporter and its major creditor with over three trillion dollars of foreign financial assets, or the equivalent of three quarters of its gross domestic product (GDP).

By 2030, on current form, China's GDP will overtake the US, possibly a bit earlier. Income per head of population, which has trebled in thirty years to about $3,700, could reach $13,000. With the west in postcrisis economic and political disarray, China's enormous impact is very clear nowadays on neighbours and the world system. What could possibly go wrong in the increasingly common refrain that the future belongs to China?

To answer this question requires impossible foresight. But we should consign linear thinking to spreadsheets, and try to understand the consequences and flashpoints resulting from economic and political processes. From a fairly long list of topics, five seem to stand out:

Ageing Fastest

First, China is an emerging market oddity in demographic terms. It is not the oldest, but it is the fastest ageing country on earth, and by 2050 it will be older than the US on every major demographic measurement. From now on, China's youth and working age populations are going to fall, and those over 65 will soar. Put another way, there will only be 2.5 workers to support each older citizen, compared with ten today.

The one-child policy is an important, though not the only, factor contributing to this enormous demographic transition. The consequences include slower economic expansion, and growing social problems as a result of chronic gender imbalance. Many wonder whether China will grow old before it gets rich.

To avoid such an outcome, China will simply have to get richer more quickly, but this entails a significant shift in the sources of economic growth - and vested political interests - from companies to consumers, and from coastal provinces to hinterland and rural areas.

Innovation Culture

Second, the demographic transition makes it even more important to sustain high levels of technological achievement. China is a big fish already in the information, low carbon, clean air, and automotive technologies. Among local 'winners' are Baidu, the local Internet search engine with eight hundred million subscribers, Alibaba, the privately owned e-commerce on line retail and cloud computing service,

Nevertheless, using and developing modern technologies is not the same as having a deeply rooted culture of innovation and entrepreneurial transformation. You can certainly create world leadership in the production of screen-based goods and green energy products and processes along the Yangtse Delta, but this is not the equivalent of a Silicon Valley, which thrives on adversarial conflict in innovation, proprietary ownership of processes, patents and copyrights, and the absence of hierarchy and political interference.

Rights And Law

Third, China's soft underbelly historically has been the relative weakness of its institutions and their ability to nurture and promote change. Perhaps size matters here. It is a lot harder to govern a large civilisation without a controlling, and sometimes repressing bureaucracy than it is a nation state. But the country's legal, social and other

In a nutshell, the issue is about whether the Party is willing and able to give citizens political, as well as economic, rights, and whether in today's rapidly modernising economy, rule by law can substitute for rule of law without thwarting or distorting economic development.

Risk of a Bust

Fourth, the government's legitimacy rests on a sort of informal social contract based on the continuous delivery of eight to nine percent economic growth. But a slowdown could occur for a variety of reasons over the next decade and beyond. These include the demographic transition; the exhaustion of past achievements, such as high literacy and school enrolments; high prices for food and raw materials as a result of the country's voracious demand; environmental constraints; and, more immediately, the growing risk of a property and asset bubble produced by excessively loose exchange rate, monetary and credit policies. This is not to argue that Beijing faces a bust any time soon, but that if it keeps treading the current path, then the risk will surely grow.

Global Tensions

Fifth, China's increasing status as a world power is already generating global tensions. When a Chinese craft recently rammed a Japanese fishing boat off the disputed Senkaku islands, the Japanese Foreign Minister wondered whether we are now starting to see the 'essence of China'.

Japan and several other countries have been concerned about China's behaviour in embargoing so-called rare earth metals, used in high technology products, and over which it has a virtual monopoly. India has been vocal about Beijing's economic and political activities in Asia at what it regards as its expense.

China's maritime build-up in Asia has the United States and regional allies on alert. Its reconstruction of a commercial-political Silk Road into the Middle East and Africa, and even Latin America, may be less colonial and more driven by the need to secure access to crucial resources. But for many it is sometimes hard to tell the difference.

These geo-political tensions are liable to get in the way of high levels of international economic cooperation and mutually beneficial policies. In the last two years, increasing trade protectionism has been one of the consequences, and more recently, currency wars, restraints over the movement of capital, and blatant acts of corporate protectionism.

If the G20 group of developed and emerging countries, but especially the G2 nations, America and China, are unable to reverse this tide and establish a proper framework to address their contrasting interests, no one would be a winner. But the economic and political consequences for China would come as a rude shock to the consensus.

In 2012, China will change its leaders, and US voters will have the opportunity to do the same. The challenges faced by the world's largest creditor and debtor nations, separately and together, are equally significant.

George Magnus, Senior Economic Adviser, UBS Investment Bank and Author,

'Uprising: Will Emerging Markets Shape or Shake the World Economy'

Available at Amazon.com:

The End of History and the Last Man

The Clash of Civilizations and the Remaking of World Order

The Tragedy of Great Power Politics

The End of the Free Market: Who Wins the War Between States and Corporations?

Running Out of Water: The Looming Crisis and Solutions to Conserve Our Most Precious Resource

Bottled and Sold: The Story Behind Our Obsession with Bottled Water

Water: The Epic Struggle for Wealth, Power, and Civilization

At War with the Weather: Managing Large-Scale Risks in a New Era of Catastrophes

Friendly Fire: Losing Friends and Making Enemies in the Anti-American Century

Dining With al-Qaeda: Three Decades Exploring the Many Worlds of the Middle East

Uprising: Will Emerging Markets Shape or Shake the World Economy

© The World Today

WORLD |

AFRICA |

ASIA |

EUROPE |

LATIN AMERICA |

MIDDLE EAST |

UNITED STATES |

ECONOMICS |

EDUCATION |

ENVIRONMENT |

FOREIGN POLICY |

POLITICS

World - China: Uncertain Leap Forward | Global Viewpoint