- MENU

- HOME

- SEARCH

- WORLD

- MAIN

- AFRICA

- ASIA

- BALKANS

- EUROPE

- LATIN AMERICA

- MIDDLE EAST

- United Kingdom

- United States

- Argentina

- Australia

- Austria

- Benelux

- Brazil

- Canada

- China

- France

- Germany

- Greece

- Hungary

- India

- Indonesia

- Ireland

- Israel

- Italy

- Japan

- Korea

- Mexico

- New Zealand

- Pakistan

- Philippines

- Poland

- Russia

- South Africa

- Spain

- Taiwan

- Turkey

- USA

- BUSINESS

- WEALTH

- STOCKS

- TECH

- HEALTH

- LIFESTYLE

- ENTERTAINMENT

- SPORTS

- RSS

- Personal Finance

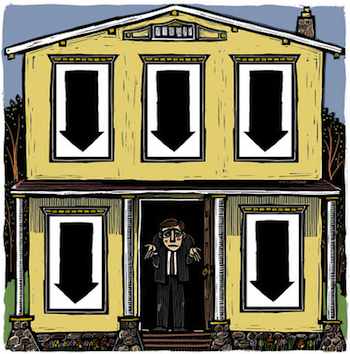

Right-sizing your finances probably isn't your idea of the best way to spend a lazy Sunday afternoon. And it certainly doesn't seem like the thing you'd want to do over your cup of morning joe.

But if your income has been slashed either by a job loss or layoff, forced furlough or just a plain old salary reduction, you may have more on your mind than just thinking about how to lead a smaller, cheaper life. You might be forced to choose between buying a bag of groceries and paying for your monthly prescriptions.

If 10 percent of the American workforce is unemployed, and another 10 percent is underemployed, has gone back to school, is staying at home or has just given up on finding a job, that 20 percent of the population isn't earning anything close to their former salaries.

On top of that, another 20 percent (or more) are earning less than they were a few years ago. If your boss asked you to take a 10 percent pay cut last year, I'm betting that it hasn't been restored yet -- and might not be for another few years.

Meanwhile, there are huge companies that in the past few years cut 401(k) matching contributions (another form of income reduction) in addition to freezing or reducing pay. While a few have restored these matching contributions, many Americans' 401(k)s, IRAs and other retirement savings accounts took a huge hit when the stock market crashed.

Are you a senior on fixed income? Then you know your bonds aren't paying what they once were. But locking in on a longer-term CD doesn't feel right, not when the inflation hawks are predicting inflation is going to skyrocket thanks to the U.S. debt. (Rising interest rates mean your bonds are worth less.)

All of which means you have to do what you can on less money each month. Rightsizing your finances is about learning not only how to spend less each month, but finding a way to be happy with a smaller, less expensive life that is hopefully equally rewarding.

How can you wipe your financial slate clean?

1. Take stock of what you're spending each month.

Write down every cent you spend, either in a cheap little notebook that you carry around with you or at an online money management site.

2. Cut out all discretionary spending.

Cut back to food, shelter, utilities, transportation (to work), child care, health care and insurance. It will be easier for you to cut out everything at first than to try to pick and choose among expenses. Since cutting the budget this drastically will affect everyone in the family, you should have the first of what will be a regular family sit-down meeting to discuss candidly where the family is financially and what can be done to ease the crunch.

3. Figure out how much cash you have left each month after taking care of the basics only.

4. Prioritize the other regular expenditures on your list.

Put savings and paying down high-interest debt at the top of the list.

5. Slowly add back a few additional expenses, including paying down other debt you may have and adding to savings.

As difficult as it is to cut your budget (and these six steps are pretty drastic), it's actually the easy part of rightsizing your finances.

Because so many of us connect money with "things" and "stuff," the bigger challenge is to replace the emotional satisfaction or adrenaline rush that some get from spending money.

If you want to build a satisfying life with the money you do have, you need to remember that experiences matter more over time than things. Spending time as a family sharing an activity, whether that is holding a garage sale or attending a free day at the local museum, will help build a stronger family bond that will resonate emotionally.

If your house needs a paint job, get the whole family involved. Brushes and paint are cheap, and the memories will last a lifetime.

The hardest part about rightsizing your finances is simply taking the first step. If you're not used to curtailing your spending, going "cold turkey" will feel awkward and uncomfortable.

It gets easier. And you'll find that, over time, rightsizing your finances feels like a simpler, cleaner way to live your life.

And for those who have to live on less, it may even be a lifesaver.

Real Estate - Right-Sizing Your Personal Finances

© Real Estate Matters, Ilyce Glink