- MENU

- HOME

- SEARCH

- WORLD

- MAIN

- AFRICA

- ASIA

- BALKANS

- EUROPE

- LATIN AMERICA

- MIDDLE EAST

- United Kingdom

- United States

- Argentina

- Australia

- Austria

- Benelux

- Brazil

- Canada

- China

- France

- Germany

- Greece

- Hungary

- India

- Indonesia

- Ireland

- Israel

- Italy

- Japan

- Korea

- Mexico

- New Zealand

- Pakistan

- Philippines

- Poland

- Russia

- South Africa

- Spain

- Taiwan

- Turkey

- USA

- BUSINESS

- WEALTH

- STOCKS

- TECH

- HEALTH

- LIFESTYLE

- ENTERTAINMENT

- SPORTS

- RSS

- iHaveNet.com

Andrew Leckey

When it comes to selecting an investment professional, trust is a relative term.

Many investors understandably feel a need for additional help in navigating today's volatile markets and economy. That means carefully checking out individual securities brokers or financial planners to find those who merit their confidence.

But no matter how impressive the credentials of any professional, recent history provides a harsh, high-visibility warning against trusting blindly:

Texas financier R. Allen Stanford promised investors higher interest rates on certificates of deposit than those of major banks.

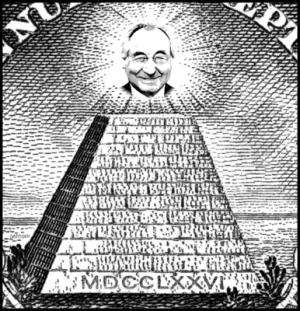

New York investment advisor Bernard Madoff reported remarkably stable gains of around 10 percent to his investors for many years.

Investors trusted both. Madoff now serving a 150-year life sentence -- and Stanford now facing criminal charges, allegedly -- for running Ponzi schemes, in which new money is paid to existing investors to give the impression of gains while the operator pockets most of the funds.

This doesn't mean you should approach every investment adviser as a crook. Select one judiciously but from then on continue to monitor your money, ask questions, be involved in decisions and scrutinize financial statements. That's what any reputable broker or financial planner would want.

"One of the biggest mistakes any investor can make is to pick someone to handle their money and completely turn everything over to that person," said Andy Millard, a certified financial planner (CFP) and president of Main Street Financial Group, Tryon, N.C. "I appreciate the trust my clients give me, but I don't want to hear, 'Oh, Andy, just go ahead because I trust you.'"

The professional should be your partner, and if you're a partner as well, "you won't end up a client of someone like Bernie Madoff," Millard said.

The selection process requires examining your own objectives and the financial services you need

A retiree in fixed-income investments won't have the same needs as a risk-taker who wants to trade options. Also compare your philosophy with that of the professional.

"Investors are nervous because of the severe declines in their portfolios, so the decision on whether to hire someone comes down to the investor's confidence about handling their own investments," said John Gannon, senior vice president in the Office of Investment Education of the Financial Industry Regulatory Authority in Washington, D.C. "If you do hire someone, different financial professionals offer different services, so find one with expertise in investments that fit your goals."

In checking out a broker's record, go online to www.finra.org/brokercheck, which has a database of more than 6,000 registered brokers, Gannon said. The database can also be accessed by calling 800-289-9999. It tells you whether the person in question is licensed, the licenses held, work history and length of time in the industry.

"The database will also tell you if someone has worked for five firms in five years -- a red flag that the person could be having a hard time," said Gannon, who noted that lack of a license is definitely a red flag. "You can get disciplinary information about the individual as well."

Find out how much the broker will charge in commission and fees, the minimum required deposit, how available the broker will be and what perks the firm may offer.

Financial planners, who formulate a detailed game plan for your financial future, should also be dealt with in an open manner that starts with the free get-to-know-each-other consultation.

"A common mistake people make is not telling the planner what's on their minds because they feel funny talking about money," said Deb Maloy, a certified financial planner in Wakefield, Mass., and president of the Massachusetts Chapter of the Financial Planning Association. "Ask a planner necessary questions in the complimentary consultation because the fit must be good for both client and planner."

Planners are either "fee-only," in which the planner is compensated on an hourly or project basis or for a percentage of assets under management; "commission-only," in which there is no charge for the planner's advice or plan preparation because compensation is solely for purchase of financial products; combination of fee and commission; or by a salary paid the planner by the financial services firm.

Professional planner designations that require education, examinations and experience include certified financial planner, certified public accountant-personal financial specialist, and chartered financial consultant.

"Start by asking planners to describe the kinds of clients they work with," said Maloy. "I work with all kinds, but if a planner says mostly people with $10 million net worth, it won't work if you're making $40,000 a year."

At the Financial Planning Association's Web site, www.fpanet.org, you can input your ZIP code to obtain the names of three financial planners in your area, Maloy said. Call or meet with them to determine if one is suitable, she said.

While services of some planners can get quite pricy, said Millard, at the low end you should at least be able to get a very basic financial plan for $300 to $500 "as a starting point."

A financial planner's history can be checked out at the Web site cfp.net.

As far as regulation is concerned, a financial planning firm that manages less than $25 million falls under state authority and above that level must be registered with the Securities and Exchange Commission.

WORLD | AFRICA | ASIA | EUROPE | LATIN AMERICA | MIDDLE EAST | UNITED STATES | ECONOMICS | EDUCATION | ENVIRONMENT | FOREIGN POLICY | POLITICS

How to Choose an Investment Professional Carefully