- MENU

- HOME

- SEARCH

- VIDEOS

- WORLD

- MAIN

- AFRICA

- ASIA

- BALKANS

- EUROPE

- LATIN AMERICA

- MIDDLE EAST

- United Kingdom

- United States

- Argentina

- Australia

- Austria

- Benelux

- Brazil

- Canada

- China

- France

- Germany

- Greece

- Hungary

- India

- Indonesia

- Ireland

- Israel

- Italy

- Japan

- Korea

- Mexico

- New Zealand

- Pakistan

- Philippines

- Poland

- Russia

- South Africa

- Spain

- Taiwan

- Turkey

- USA

- BUSINESS

- WEALTH

- STOCKS

- TECH

- HEALTH

- LIFESTYLE

- ENTERTAINMENT

- SPORTS

- RSS

- iHaveNet.com: Economy

by Jesse Jackson

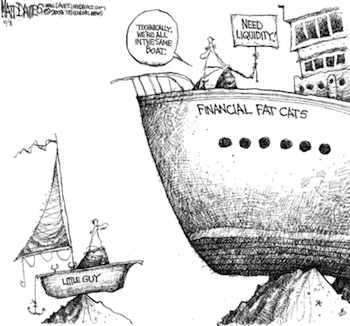

A rising tide may lift all boats (except, of course, those stuck at the bottom). But, as we learned over the last year, refloating the yachts doesn't create the tide.

Under Presidents Bush and Obama, the Federal Reserve's Chairman Ben Bernanke and Treasury Secretaries Hank Paulson and Tim Geithner repeated one constant argument. They had to resuscitate the banks, they said, because finance is the lifeblood of the economy. If the banks went down, financing would freeze up, and the economy would die. They rescued the banks not to save the banks, but to save the real economy. So they pumped billions into the banks, created trillions in subsidies and swaps, and kept interest rates near zero to bolster the banks' balance sheets, and stave off financial collapse.

It worked in a fashion. The banks are back, making profits, and are gearing up to announce lavish bonuses -- six, seven, eight-figure (that's over $10 million) bonuses for their leading producers.

But refloating the banks didn't create a tide. Unemployment is in double digits and rising. Foreclosures of homes are rising. Personal bankruptcies are at record levels. Incomes are stagnant or worse. State and local budget crises will be worse this year than last, with cuts and layoffs growing. American families aren't recovering even if the economists say the economy is.

There is a fundamental disconnect. The economy can't revive without a functioning financial system, but the banks can profit big time without Americans benefiting. Banks can borrow money at zero percent from the Federal Reserve and buy into rising stock markets abroad. They can invest in companies moving jobs to growth areas like China. They can profit by making bets on minute movements of stock and bond markets that have nothing to do with helping small businesses with the financing they need.

So the banks are making money, but the U.S. economy isn't benefiting very much. Small businesses still can't get loans. The banks are still resisting rewriting mortgages, so home foreclosures keep rising. Wall Street is thriving, but the rest of the country is not.

That's why the debate on jobs and on financial reform that is about to heat up in the Congress is so important.

It isn't enough to get the financial system operating; we have to put people to work. Businesses won't hire until they see customers. States and localities won't stop layoffs until they see tax revenue. None of that will happen unless people go to work. But the financial collapse cost Americans literally trillions of dollars. Consumers are tightening their belts. So to counter the Great Recession, we need the government to put people to work, issuing contracts to weatherize government buildings, renew our sewers, repair our schools, or extend our parks. There is a lot of work to be done that requires public funding; now is the time to do it.

And it isn't enough to rescue the banks; they have to be reformed. We've got to separate the speculators from the banks that take deposits and get federal guarantees. We've got to demand that banks offer plain vanilla products -- simple, fixed rate mortgages, credit cards without surprises -- so consumers don't get gouged. We have to create more incentives for lending money to small businesses, and put some speed bumps on excessive speculation.

And there must be an effort to enforce the civil rights laws. One of the reasons for the financial collapse is that basic protections against discrimination went unenforced. So, the banks could target minority neighborhoods that they used to ignore, and give brokers incentives to peddle complicated mortgages with rising interest rates and balloon payments, even when they knew the borrower had no chance to repay the loan.

In the

At this point, that hasn't happened. The big banks are emerging from the crisis more concentrated than ever. They've been told they are "too big to fail," but have no limits on the bets they can make. That means they pocket the profits if they win, and taxpayers clean up the mess if they lose. This is like handing out liquor bottles to drivers while offering insurance for any damages to the car. The ride might be thrilling, but the crackup is sure to come.

WORLD | AFRICA | ASIA | EUROPE | LATIN AMERICA | MIDDLE EAST | UNITED STATES | ECONOMY | EDUCATION | ENVIRONMENT | FOREIGN POLICY | POLITICS

Rising Yachts Lift No Tides | Jesse Jackson