- MENU

- HOME

- SEARCH

- WORLD

- MAIN

- AFRICA

- ASIA

- BALKANS

- EUROPE

- LATIN AMERICA

- MIDDLE EAST

- United Kingdom

- United States

- Argentina

- Australia

- Austria

- Benelux

- Brazil

- Canada

- China

- France

- Germany

- Greece

- Hungary

- India

- Indonesia

- Ireland

- Israel

- Italy

- Japan

- Korea

- Mexico

- New Zealand

- Pakistan

- Philippines

- Poland

- Russia

- South Africa

- Spain

- Taiwan

- Turkey

- USA

- BUSINESS

- WEALTH

- STOCKS

- TECH

- HEALTH

- LIFESTYLE

- ENTERTAINMENT

- SPORTS

- RSS

- iHaveNet.com

Ilyce Glink

Q: Your recent column gave me the idea that you might be able to help me with my mortgage problem.

I am thinking of applying for a mortgage modification through Home Affordable Mortgage Program (HAMP). We bought our home for

Our housing costs (principal, interest, taxes, insurance, and association dues) currently exceed 60 percent of our income. I am 58 my wife is 55, we are both retired. She has a brain tumor, which makes her uninsurable, so we have to get insurance from our state's high-risk pool. Our deductible medical expenses have been over

We have not yet missed a payment and have heard that the banks only really take action after a payment is missed. What is the chance of getting a principle reduction through HAMP? Will they refuse to modify since we are not employed (but do have verifiable and stable income)?

Should I hire a lawyer or loan modification company to take care of my HAMP application or can I do it myself? Any other thoughts or suggestions you might have would be appreciated. Thank you.

A: Unless you live in a HUD-designated "high-cost" area like San Francisco, you don't qualify for HAMP because your loan is for

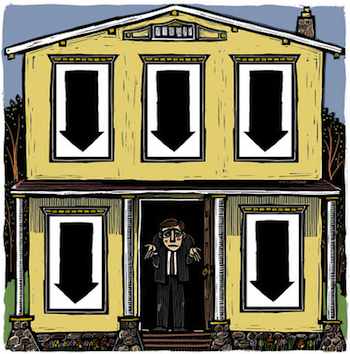

Your best bet is to talk to your lender about doing a custom loan modification, but I have no idea if they'll be willing or able to do anything. You're essentially asking them to cut off a huge hunk of principal and they might just say no. In that case, your best option would be to simply hand over the house to the lender, or do a deed-in-lieu of foreclosure if you can no longer afford the payments.

You're right -- until you miss a payment your lender will likely be unwilling to do anything. So you'll be stuck with a destroyed credit history and credit score no matter what.

While it shouldn't be that way, and lenders should be willing to modify loans that are not delinquent but might become delinquent in the future, lenders are busy working on loans that are delinquent and may not see a need to work with a borrower who is current on his or her loan.

When it comes to HAMP modifications, the success rate has been rather dismal. From what I have heard, only about 5 percent of all temporary loan applications have gone on to become permanent and only about 10 percent of all applications have been approved as trial loan modifications. With those numbers, it may not make sense to pay someone to help you with the loan modification.

The paperwork involved for a loan modification is similar to the paperwork you would deliver to a lender if you were refinancing your loan. You would, however, also need to present a hardship letter outlining why you believe the lender should give you the loan modification based on your circumstances.

Most trial loan modifications reduce the amount of interest that the borrower is paying, thus lowering the interest rate. Generally, principal reductions are not being done, but lenders will do forbearance agreements, where you simply don't make payments for a period of time.

In your circumstances, you should definitely talk to your lender about a loan modification. But if you can't get a loan modification, you must assess your finances and determine what is best for you and your family, given what you are going through.

You might wish to consult with a real estate attorney in advance of calling the lender. But you should do your own negotiating. I haven't yet met a lender who says that hiring an attorney for

Good luck, and let me know what happens.

Q: In 2006, I purchased a large tract of timberland in central Georgia -- about 130 acres in total. The purchase was strictly for investment purposes. My plan was to sell it over two years and make a decent profit.

I did the research and given market conditions and demographics at the time, my goal was not unreasonable goal.

I sold 20 acres within the first year and made good money. But I still have 110 acres to sell and, in this economy, it ain't movin'. Yes, I can sustain the carrying costs for another year or two if I had to, without dipping into savings or ruining myself financially.

But I've done the math. If I sold the land tomorrow, I'd barely break even. Each month that goes by, I'm losing more money -- money that I'll never see as return on investment.

I've considered selling some of the timber, but timber prices are down right now so that wouldn't make much of a dent, plus it would devalue the property.

So do I drop my price dramatically, stop the bleeding, sell it to some bottom feeder and get out? (I would likely have to eat a large sum but at least I'd be done with it.) Or do I hang on indefinitely, continue making payments each month, and wait for things to turn around? I lose money either way. I just don't know which way to go.

I would greatly appreciate any advice you have.

A: The question of whether you'll lose more money by hanging on or by dumping the land now is one only you can answer. You're there and I'm not. You're the one seeing what's happening. And only you know what your true costs are.

My feeling is that if you don't have a prayer of making money in the next three to four years, you should get rid of the land. What happens if you have it for five to 10 years before selling it? A lot can happen in that time.

It sounds as though you made some money on some of the acreage. If you can get your base cost out of the rest, you'll be a little ahead -- which in the worst real estate recession in 70 years is saying something.

I know a lot of developers who would be delighted to trade places with you.

One final thought: Is your land tradable for another asset? You may wish to explore this and consider a 1031 exchange. Perhaps you'll have better luck with a different type of asset.

If you have taken any depreciation (but not on the land), you might have to pay a tax when you sell the land with the timber. A 1031 exchange is a mechanism in which you sell this land and buy some other land and defer the payment of any federal income taxes on that sale.

If you have not taken depreciation, and will only have a loss, then a 1031 tax deferred exchange may not be right for you.

WORLD | AFRICA | ASIA | EUROPE | LATIN AMERICA | MIDDLE EAST | UNITED STATES | ECONOMICS | EDUCATION | ENVIRONMENT | FOREIGN POLICY | POLITICS

Real Estate - Loan Modification Much Harder to Get for Jumbo Mortgage