- MENU

- HOME

- SEARCH

- WORLD

- MAIN

- AFRICA

- ASIA

- BALKANS

- EUROPE

- LATIN AMERICA

- MIDDLE EAST

- United Kingdom

- United States

- Argentina

- Australia

- Austria

- Benelux

- Brazil

- Canada

- China

- France

- Germany

- Greece

- Hungary

- India

- Indonesia

- Ireland

- Israel

- Italy

- Japan

- Korea

- Mexico

- New Zealand

- Pakistan

- Philippines

- Poland

- Russia

- South Africa

- Spain

- Taiwan

- Turkey

- USA

- BUSINESS

- WEALTH

- STOCKS

- TECH

- HEALTH

- LIFESTYLE

- ENTERTAINMENT

- SPORTS

- RSS

- iHaveNet.com

Luke Mullins

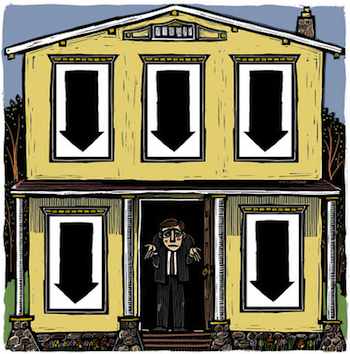

Facing a tricky balancing act of keeping the housing market alive while protecting its eroding balance sheet, the

1. Falling reserves:

The FHA is a federal agency that insures home loans against default. But in the wake of the housing bust, the tiny agency has become an increasingly essential cog in the mortgage finance machine. While the FHA guaranteed just 3 percent of new home-purchase mortgages in 2006, it is insuring roughly 30 percent of home loans today. The agency's rapid growth is linked to its lending standards, which have remained liberal even as private lenders aggressively increased requirements. For example, most borrowers can get an FHA-backed loan with only 3.5 percent down, while loans without a similar government guarantee often come with down payments in the 10 to 20 percent range. However, the FHA's lending portfolio has faced rising defaults, which have pulled its capital reserves below its congressionally-mandated threshold. These financial headaches have put political pressure on the agency to increase its lending standards.

2. Higher insurance premiums:

The FHA said it would increase its up-front mortgage insurance premiums by half a percentage point, to 2.25 percent. But since the upfront premium can be rolled into the loan itself, the impact on borrowers will be minimal. The change should increase monthly payments for median-sized property owners by perhaps $10, according to Guy Cecala, the publisher of Inside Mortgage Finance. At the same time, the agency pledged to seek Congressional authority to increase its annual mortgage insurance premium, which is already as high as the law allows it.

3. Increasing down payment requirements (for some):

In addition, new borrowers with FICO scores of less than 580 will now have to put at least ten percent down to obtain an FHA-backed loan. Those with credit scores at or above this threshold can still get an FHA loan for only 3.5 percent down. "To put this into perspective, the average FICO score for

4. Reduced concessions:

In addition, the FHA moved to reduce the amount of cash that sellers can put towards buyers' closing costs from 6 to 3 percent of the home's purchase price. The agency also unveiled a series of steps to bolster its enforcement of FHA-approved lenders.

5. Impact: FHA Commissioner David Stevens was in a jam. His agency's deteriorating finances created political pressure to boost its lending standards. But with the FHA now backing three in every ten mortgages--and more than half in some markets--he couldn't jack them up to the point where they choked off mortgage demand. The policy changes announced Wednesday reflect the conviction that propping up housing demand--at least for now--is more important that keeping borderline credits off the FHA's books. After all, the move helps ensure that all but the least credit-worthy borrowers can still qualify for government-backed, fixed-rate home loans with just 3.5 percent down. "If we were solely focused on capital reserves, and had no care about what happened to the housing finance system?decisions may have been made differently," Stevens said during a conference call with reporters.

Republicans, at least initially, were heartened by the FHA's modest changes. Rep. Scott Garrett, a Republican from New Jersey, has introduced legislation to boost the FHA minimum credit requirements to 5 percent. In an interview Wednesday, Rep. Garrett said he was encouraged by the agency's moves because it demonstrated the FHA's potential to make additional changes. "It's a preverbal good start," he said.

Still, Rep. Garrett pledged to continue his fight to boost FHA minimum down payment requirements.

WORLD | AFRICA | ASIA | EUROPE | LATIN AMERICA | MIDDLE EAST | UNITED STATES | ECONOMICS | EDUCATION | ENVIRONMENT | FOREIGN POLICY | POLITICS

Government Backed Mortgages: New FHA Requirements