- MENU

- HOME

- SEARCH

- WORLD

- MAIN

- AFRICA

- ASIA

- BALKANS

- EUROPE

- LATIN AMERICA

- MIDDLE EAST

- United Kingdom

- United States

- Argentina

- Australia

- Austria

- Benelux

- Brazil

- Canada

- China

- France

- Germany

- Greece

- Hungary

- India

- Indonesia

- Ireland

- Israel

- Italy

- Japan

- Korea

- Mexico

- New Zealand

- Pakistan

- Philippines

- Poland

- Russia

- South Africa

- Spain

- Taiwan

- Turkey

- USA

- BUSINESS

- WEALTH

- STOCKS

- TECH

- HEALTH

- LIFESTYLE

- ENTERTAINMENT

- SPORTS

- RSS

- iHaveNet.com

Ilyce Glink

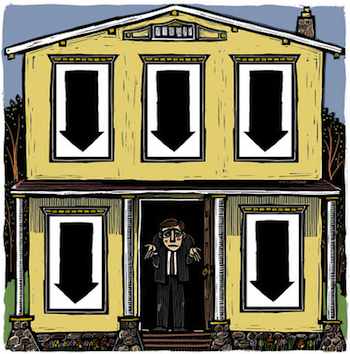

If your home is worth less than what you owe, would you walk away from the home and allow it to go into foreclosure?

How much less? What if your home is worth 75 percent of the loan amount? What if it is worth half of what you owe?

What if your home is worth only 25 percent of the loan amount? Would you walk away at that point?

According to new research by First American CoreLogic that will be published in the upcoming "Negative Equity Report," homeowners whose homes are worth less than 75 percent of the mortgage amount are most apt to simply walk away and let the home fall into foreclosure -- even if they have the means to pay.

The results of the study seem to show that homeowners face a mental hurdle that melts away as the equity in their home disappears.

So if the home you bought for $400,000 is now worth less than $300,000, you'll think seriously about a strategic default, even if you have the means to pay.

How many homeowners are occupying homes that are worth less than 75 percent of the mortgage amount? Plenty.

According to data, in 2006, as the housing bubble burst, there were few homeowners who had negative equity (homes worth less than the mortgage amount).

Four years later, more than 4 million homeowners find themselves paying the mortgage on property that might never recover in value. With the housing market recovery slowing, the number of homeowners with homes worth less than 75 percent of the mortgage amount could jump to more than 5 million, or a full 10 percent of the total number of homeowners with mortgages in the U.S.

At what point is it worth simply throwing up your hands and preserving your wealth for your next move?

The first hurdle is to determine whether you live in a state that allows lenders to pursue you for a deficiency judgment. A deficiency judgment means a lender can go after your other assets if the company forecloses on the property and resells it for less than you owe on the mortgage.

So if you owe the lender $400,000 and the lender forecloses and resells the property for $200,000, and you live in a state that permits deficiency judgments, the lender could come after your other assets to pay up the missing $200,000.

But many states do not allow deficiency judgments. In those states, the lender agrees to accept title to the property if you can't pay, and does not try to attach liens to other assets.

If you live in a state that doesn't allow deficiency judgments, it paves the way for you to simply mail the keys back to the lender -- if you're able to let go of the emotional attachment you have to the property.

According to a spokeswoman for First American CoreLogic, a homeowner's emotional attachment to the property fades as the home loses value. Once a house is worth less than 75 percent of the mortgage amount, the homeowner's emotional attachment disappears.

That could spell trouble for lenders who are expecting as many as 7 million additional foreclosures by the end of 2011. While some of the expected 5.1 million homeowners who will own homes worth less than 75 percent of the mortgage amount are included in that number, plenty are not.

Lenders expect that if you haven't lost your job or experienced some other sort of financial hardship, you will continue to pay your mortgage even if your house is worth half of the mortgage amount.

But homeowners who choose a different path, and who think about their finances strategically, may decide they are far better off handing back the keys to the lender, taking an immediate hit to their credit history and score, and moving forward with their financial lives.

If even a million homeowners make the decision to strategically default, it could change the mortgage industry as we know it.

© Real Estate Matters, Ilyce Glink

WORLD | AFRICA | ASIA | EUROPE | LATIN AMERICA | MIDDLE EAST | UNITED STATES | ECONOMICS | EDUCATION | ENVIRONMENT | FOREIGN POLICY | POLITICS

Real Estate - Foreclosure: When Should You Walk Away From Your Home