- MENU

- HOME

- SEARCH

- WORLD

- MAIN

- AFRICA

- ASIA

- BALKANS

- EUROPE

- LATIN AMERICA

- MIDDLE EAST

- United Kingdom

- United States

- Argentina

- Australia

- Austria

- Benelux

- Brazil

- Canada

- China

- France

- Germany

- Greece

- Hungary

- India

- Indonesia

- Ireland

- Israel

- Italy

- Japan

- Korea

- Mexico

- New Zealand

- Pakistan

- Philippines

- Poland

- Russia

- South Africa

- Spain

- Taiwan

- Turkey

- USA

- BUSINESS

- WEALTH

- STOCKS

- TECH

- HEALTH

- LIFESTYLE

- ENTERTAINMENT

- SPORTS

- RSS

- iHaveNet.com

Kent Garber

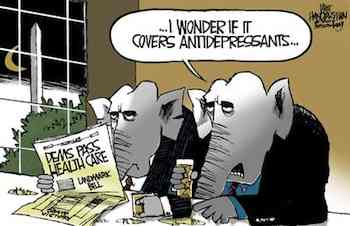

Public option. Individual Mandate. Doughnut Hole. Excise tax.

These terms are so complicated, and so abstract, it's no wonder that more than half of Americans, according to a recent poll, say they still don't know what the Democrats' healthcare bill contains.

Here's a cursory look at what's in the legislation that the

1. Insurance for millions

Under the legislation, 32 million more people will have health insurance in 2019 than without the bill.

That means that about 94 percent of all U.S. citizens will have insurance by the end of the decade. That still falls short of "universal coverage," but it's a significant increase from the 83 percent of American citizens who are covered today.

2. Coverage for people with pre-existing conditions

Right now, insurance companies can deny coverage to people with "pre-existing conditions," like cancer and heart disease, to name just two of many. The healthcare bill would ban this practice.

3. Help buying insurance

Lower-income Americans who can't afford to buy insurance will get help in one of two ways. The bill expands

4. Help for prescription drugs

Right off the bat, the bill will give seniors a

5. Penalties for people who don't buy insurance and companies that don't offer it

The bill has what's called an "individual mandate," which means that most Americans, starting in 2014, must have insurance or face a penalty. The penalty would be

6. No "public option"

Much of the debate in the past year was consumed by talk about the "public option," which was pushed by liberal Democrats who wanted the government to provide an alternative to private insurance plans.

The House included it in its bill last fall, but the

7. No traditional

Seniors won't see cuts to their regular

In an effort to cut spending, the bill gradually cuts the amount the government will give private insurers to offer

8. Higher taxes for the wealthy

To help pay its

For example, the

9. Cutting the deficit

Even though Republicans say the bill is too expensive and spends wastefully, the Congressional Budget Office says that it will

actually help cut the deficit, by more than

10. Making healthcare cheaper

The cost of healthcare for Americans (and the amount the government spends on healthcare) has been rising for more than a while now. The bill has several ideas for "controlling costs," including experiments to pay hospitals and doctors a lump sum for treating a particular patient, rather than paying them for every single test and procedure they provide.

There are also programs in the bill to bring medicine into the digital age. Experts say these ideas could be game-changing, but it's too early to tell if they'll actually work.